36+ when should i lock my mortgage rate

For example your lender may offer a 30-day lock for free but if you. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Bank Of Queensland Boost Savings Account To 4 90 P A Pipping Ing

Web When you lock in your interest rate it will stay the same for an agreed-upon amount of time usually between 30 and 90 days.

. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web Mortgage Rate Lock Fees. Web A rate lock is when your lender agrees to honor a particular interest rate by locking it into your loan for a certain amount of timetypically 30-60 days or long.

Web Your lender might lock in a mortgage rate for a fee as a way to protect you from any interest rates increases while you shop for a home. Web If mortgage rates fall after you lock your rate you still have options. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

You usually can lock in a. Select mortgage lenders may offer a rate lock extension. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

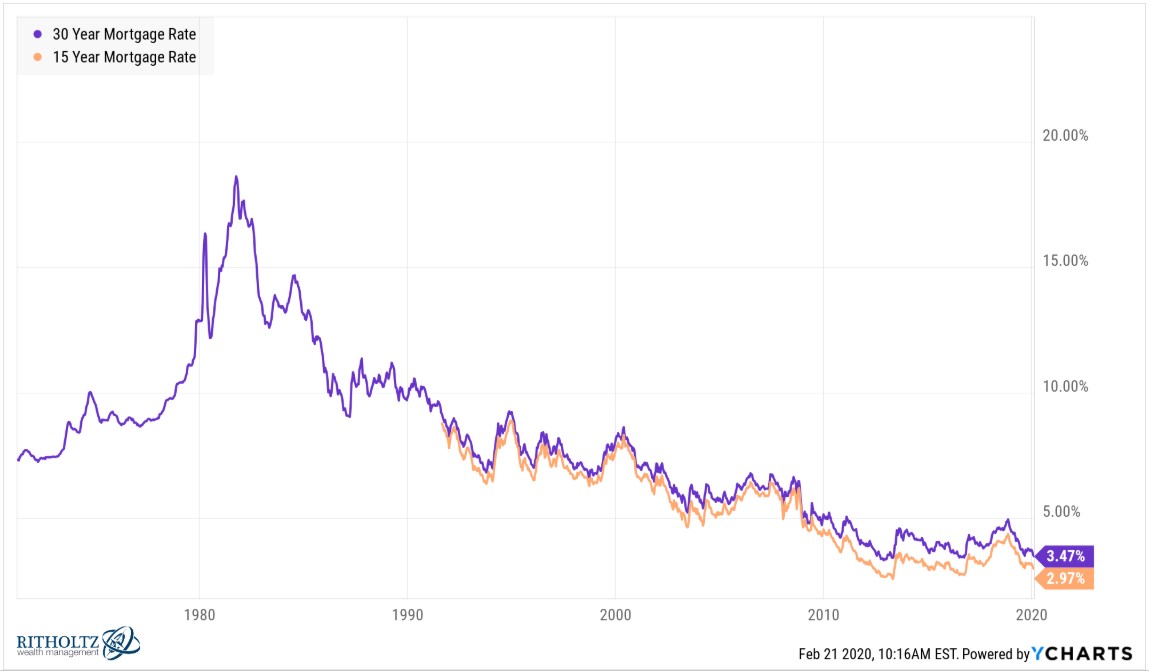

You may be able to stop the process with your current lender and start over with a different. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web When the Fed drops interest rates buying a home becomes more affordable.

When you choose the term of your mortgage rate lock the shorter the term the lower the. Web If your rate lock will expire prior to closing and disbursement of funds a rate lock extension will be required to close your loan. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

The longer your rate lock the more likely it is to come with fees. We will extend your rate lock at no cost to you. As a result whether you should lock in your interest rate depends on where.

Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days. Save Time Money. Web You should lock your mortgage rate as soon as possible in the mortgage process as long as youve already shopped quotes from at least three to five lenders.

Web If you see a competitive mortgage rate when you start your mortgage application it may no longer be there weeks or months later when you finally close. If you dont want to miss. Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified time.

This means you wont need to worry about rates. Web Rate lock periods usually last between 15 and 60 days with longer-term rate locks being more expensive. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Web When to lock depends on the closing date of your home purchase. You may be able to.

How To Get A Mortgage Home Loan Tips

Should You Lock Your Mortgage Rate Today Forbes Advisor

Should You Pay Off Your Mortgage Early With Rates So Low

When Should You Lock In Your Mortgage Rate Right By You Mortgage

Rba Cash Rate February 2023 Which Banks Are Increasing Savings Account Rates

Mortgage Rate Locking Meaning When To Do It Mashvisor

When Should You Lock A Mortgage Rate Moreira Team Mortgage

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

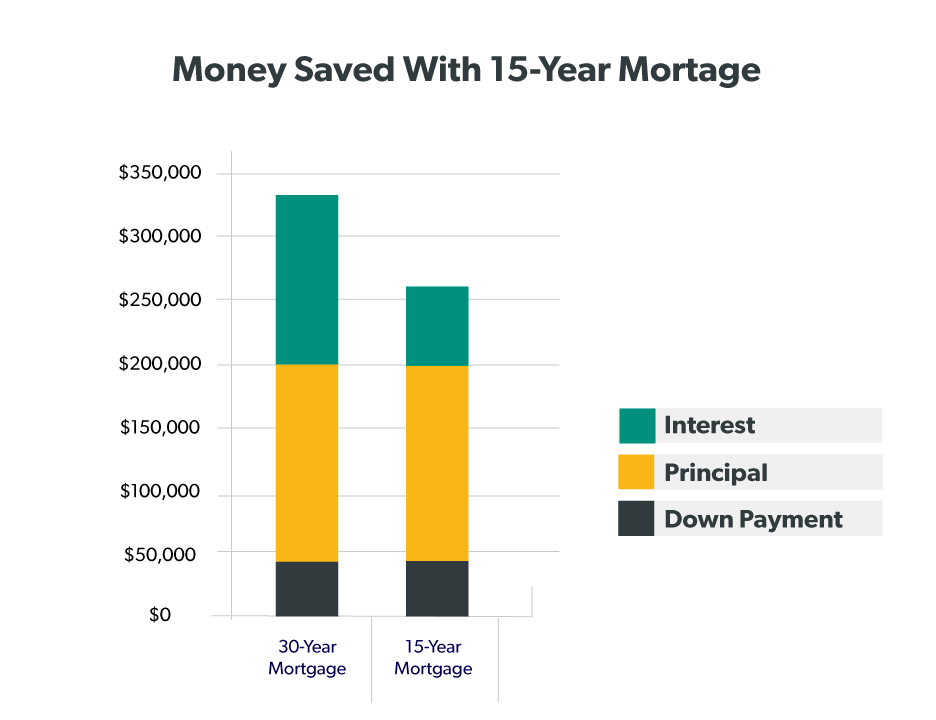

What You Need To Know About 15 Year Mortgages The Motley Fool

When To Lock In My Mortgage Rate Chase

Mortgage Rate Locks What You Need To Know

How To Get A Mortgage Home Loan Tips

Coronavirus Finance Bills Help

Mortgage Rate Locks The Complete Guide Fees Faq S More

When Should You Lock A Mortgage Rate Bankrate

What Is A 30 Year Fixed Rate Mortgage Ramsey